Bench simplifies your small business accounting by combining intuitive software program that automates the busywork with real, skilled human support. Did we proceed to comply with the rules of adjusting entries in these two examples? This recognizes that 1/12 of the annual property tax quantity is now owed on the finish of January and includes 1/12 of this annual expense amount on January’s revenue assertion. In this text, we shall first focus on the purpose of adjusting entries and then explain the tactic of their preparation with the help of some examples. This is because https://www.simple-accounting.org/ they’re an obligation that the company is predicted to pay sooner or later. To make certain you’re not including extra duties to your to-do listing like having to inspect it and manually post, you need to put money into a social media management device.

The firm could make the accrued wages journal entry by debiting the wages expense account and crediting the wages payable account at the period-end adjusting entry. As such, recording accrued liabilities such as for a wage payable journal entry is pivotal in ACCA’s Financial Accounting (FA) and Monetary Reporting (FR) papers. This is said to the accrual idea which states bills should be matched with the appropriate accounting interval.

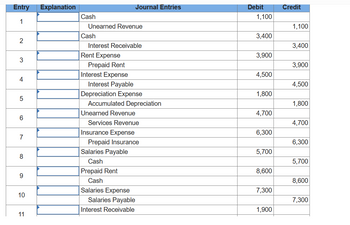

( Adjusting Entries For Accruing Unpaid Expenses:

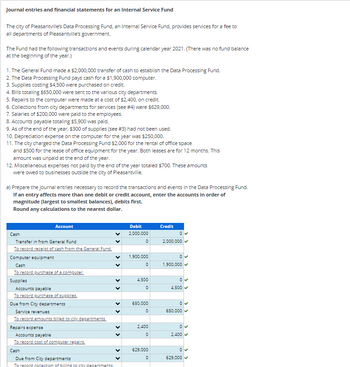

Some examples include interest, and services accomplished but a bill has but to be despatched to the shopper. DOKKA is an AI-powered close administration platform designed to simplify and accelerate the monetary close process. By reducing manual work and enhancing accuracy, DOKKA helps finance groups shut their books sooner and with larger confidence. The process of creating guide adjusting journal entries may be advanced and time-consuming, particularly when dealing with massive volumes of transactions across multiple accounts. This is where automation could make a major distinction by streamlining the process and lowering the chance of human error. In this submit, we’ll discover what adjusting journal entries are, the different sorts of changes, when they’re wanted, and tips on how to make them successfully.

The Taxes Payable balance becomes zero since the annual taxes have been paid. An expense is a cost of doing enterprise, and it cost $4,000 in wages this month to run the business. I really do not perceive the way to put together the first requirement, as a end result of it specifies that it incurred wage expense, and owes extra, but doesn’t say if they paid it off. In all the examples in this article, we shall assume that the adjusting entries are made at the finish of every month. Wage expense has to extend $ 5,000 on the earnings statement and document the lialbity on stability ehseet.

The accrued unpaid wages legal responsibility is included within the stability sheet of the business under current liabilities, as it is because of be paid within twelve months of the steadiness sheet date. Likewise, this journal entry is to recognize the liabilities that the corporate owes to its workers for the work that they have accomplished in December 2019. If there isn’t any recording of the above, whole expenses and total liabilities might be understated by $15,000. In this case, in the December 31 adjusting entry, the company ABC needs to make journal entry for accrued salaries to acknowledge the salary expense that has already occurred as beneath. In Tally, you’ll find a way to document the salary payable journal entry using journal vouchers. The wage payable journal entry with TDS provides full transparency in information.

In other words, it’s to settle the salaries payable that the company owes its employees for work they have carried out in December 2019. However, the right journal entry for accrued salaries is important on the period-end adjusting entry. This is so that complete expenses through the period in addition to the total liabilities on the reporting date usually are not understated. Cadmagnet Engineering Services Pvt Ltd has a wage payable for the month of August 2020 amounting to ₹25000. Notice that when the cash is actually paid, you don’t document any expenses; as a substitute, you lower the Accrued Payroll Expense account, which is a liability.

( Adjusting Entries That Convert Liabilities To Revenue:

In this case, Unearned Payment Revenue will increase (credit) and Cash will increase (debit) for $48,000. There are a few different guidelines that assist the need for adjusting entries. Depreciation spreads the cost of an asset over a quantity of durations, somewhat than recognizing the total price as an expense in the period when the asset was purchased.

- Outstanding wage is legal responsibility by nature, subsequently, it’s shown in the legal responsibility facet of the balance sheet.

- Multiply these hours worked by the wage rate for each employee to derive gross pay.

- However with accrual, the expenses show up on your earnings statement in June as your worker purchases the supplies.

- If for instance, the accounting period (month one) ended on a Thursday, the business would want to accrue for unpaid wages for 3 days, Tuesday, Wednesday, and Thursday.

- The stability in the supplies account at the end of the year was $5,600.

On January 31, 2021, there are 5 new workers that have simply began working for 3 days. Nonetheless, generally, the corporate may have the policy to solely make the cost of the wages for the worker which have labored for a sure time frame (e.g. one week). And wages of the staff which have worked less than a sure period of time (e.g. new employee) might be accrued for the following cost period.

At the top of accounting interval, some amount of wage may not but be paid to the worker as it’s not reached the cost schedule but. Nevertheless, the company has to document it as an expense to comply with accrued fundamentals. You only record accrued bills in your books should you run your corporation underneath the accrual basis of accounting. Each entry has one income statement account and one stability sheet account, and cash doesn’t seem in either of the adjusting entries.

If the company earned $2,500 of the $4,000 in June, it should journalize this quantity in an adjusting entry. This entry recognizes the price of your employees’ labor during the accounting period—even should you haven’t paid them yet. It’s all about maintaining your financial statements accurate and in line with reality (and keeping the auditors off your back). Pay As You Go bills are an asset on your balance sheet as it displays a future value—multiple months of a social media administration tool—for your corporation. Then each month, you need to make an adjustment to replicate the month-to-month expense of the subscription. If you run your corporation using money accounting, you report expenses the moment you pay for them, and you won’t have accrued bills in your books.

One difference is the supplies account; the figure on paper does not match the value of the supplies stock nonetheless available. The accounts that are highlighted in brilliant yellow are the model new accounts you simply discovered. These highlighted in pale yellow are the ones you discovered previously. Remember, this example doesn’t embody potential complexities like tax withholdings or other deductions from pay, which would also have to be accounted for in a real-world scenario.